Simplify banking operations, improve customer relationships, and ensure compliance easily. Get started with LeadHeed CRM today to transform your banking experience.

Free 14-day trial

No credit card required

Cancel anytime

Trusted and Recommended By 1000+ Industry Leaders

How to Set Up LeadHeed CRM Software for the Banking Industry?

Setting up LeadHeed CRM software for the banking industry is simple. To get started, sign up, import client data, create custom fields for accounts, and segment contacts. Also, set automated reminders, assign tasks, and integrate banking tools for streamlined management.

Start your free trial today!

Unlock the full potential and

ready to take your sales to the next level.

What is a Banking CRM?

A banking CRM is a software designed to help the banking industry manage and smoothen their relationships with customers. It gives the overall view of client data, helps to track interactions, automated workflows, and manages tasks like loan approvals and more.

CRM for banks is a centralized platform for managing client information, helping banks to improve efficiency, customer service and increase productivity.

Benefits of CRM Software for Bankers & Financiers

CRM software allows bankers and financiers to improve customer interaction, efficiency, compliance, etc., helping to enhance productivity and growth.

Improved Customer Relations

CRM allows for customized communication, better knowledge of customer needs, and loyalty through targeted services and engagement.

Streamlined Operations

By integrating all processes into one platform, CRM automates internal functions, saving time, improving task management, and ensuring smooth day-to-day functions.

Enhanced Sales

CRM supports focused marketing, cross-selling, and promoting through tracking customer preferences, which eventually improves revenue and client relationships.

Effective contact management is at the heart of any successful business strategy.

Improved Efficiency

CRM helps in task automation, centralization of information, and efficient processes to improve the speed of work, saving resources and time for customers.

Enhanced Data Management

CRM integrates customer data in a single place, making it readily available so that everyone can have easy access.

Regulatory Compliance

CRM helps banks in meeting regulatory requirements with automated verification of compliance, document storage, and audit report generation.

What Kind of Bankers Is LeadHeed’s CRM Software Best For?

LeadHeed CRM is tailored to meet the needs of various banking professionals, with tools to help them in every stage of the banking cycle

Retail Bankers

CRM helps retail bankers via customer accounts management, improving customer interaction leading to increased satisfaction and loyalty.

Relationship Managers

Relationship managers can use LeadHeed to have a 360-degree customer view, track interactions, and ensure personalized financial solutions.

Loan Officers

Loan officers can automate lead tracking, simplify application processes, and follow up, improving the speed and accuracy of loan approvals and customer service.

Mortgage Specialists

Mortgage specialists use CRM to process mortgage applications, track customer progress, create automated reminders of follow-up calls, and respond in a timely manner.

Investment Advisors

Investment advisers benefit from using CRM to control client portfolios, track investment performance, and offer tailored recommendations.

Branch Managers

Branch managers use CRM to control daily operations, track staff performance, track customer satisfaction, and provide effective branch-level processes.

Comparison of Top CRM Software For Banking Industry

Explore the best CRM software for banking industry to boost efficiency and streamline your workflow. This quick comparison highlights top software based on features, ease of use, and compatibility, helping you choose the right fit for your business.

Features  Companies  | ||||

|---|---|---|---|---|

| Marketing Automation | ||||

| Integrations | ||||

| Contact Management | ||||

| Task Assignment | ||||

| Pipeline Management | ||||

| Email Management | ||||

| Social Relationship Management | ||||

| iOS App | ||||

| Android App | ||||

| Pricing | Starts from $12 per month | Starts from $15 per month | Starts from $25 per month | Starts from €10 per month |

LeadHeed’s Best CRM Features For Banks & Finances

LeadHeed CRM offers strong features designed to simplify operations, promote better customer relationships, and allow smooth management of banking activities.

Customer 360-Degree View

Provides a complete view of customers, such as interactions, preferences, and history, to facilitate the customization of services and achieve maximum customer satisfaction.

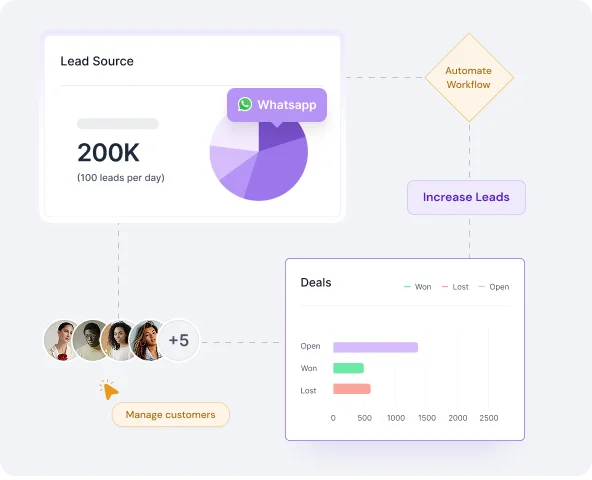

Automated Lead Management

Simplifies capturing, nurturing, and conversion of leads via automated methods, helping in timely follow-ups and improved lead-to-customer conversion.

Loan & Credit Management

LeadHeed simplifies loan application processing, tracing, and payment schedules, providing an easy way to manage loans and making it the best CRM software for banks.

Regulatory Compliance Tracking

Protects all customer information, transactions, and banking activity from industry compliance, providing tracking of compliance and preventing possible breaches.

Data Analytics & Reporting

Offers detailed insights and real-time reports on customer data, financials, and trends, allowing banks to make effective decisions and boost profitability.

Client Segmentation

Segment customers based on demographics, behavior, and needs, allowing banks to personalize services, create focused campaigns, and improve customer engagement.

Multi-Channel Communication

Integrates communication channels like email, phone, chat, and SMS, allowing banks to reach customers via preferred channels improving accessibility and customer experience.

Document Management

Centralizes the storage of customer and banking documents, enabling easy access, secure sharing, and efficient management.

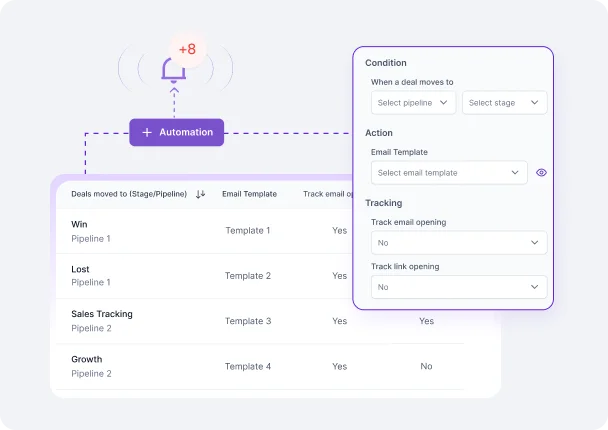

Automated Workflow

Automates repetitive work and processes so that bankers can focus on more important activities, saving time and increasing productivity.

PRICING

Select a plan that suits you

Pay Monthly

Pay Annually (Save up to 20%);

$0

Per user, per month.

Free

Get started with full access for a limited time, no credit card required.

No card required

Our Free plan gives you:

- 5 users

- 10,000 contact management

- Limited contacts & companies

- Lead Source Tracking

$15

Per user, per month.

Pro

Essential tools to help you grow, perfect for individuals and small teams.

Free 14-day trial. No card required.

Everything in Free plan, plus:

- Bulk Contact Import/Export

- 2 Sales Pipeline Management

- Lead Scoring

- Sales Automation

- Workflow Tracking

- Task Reminders

Most Popular

$35

Per user, per month.

Elite

Unlock advanced features and priority support, built for scaling businesses.

Free 14-day trial. No card required.

Everything in Team, plus:

- Unlimited Sales Pipeline Management

- Email Automation

- Social Media Integration

- Form Builder

- Messaging and live chat

$0

Per user, per month.

Free

Get started with full access for a limited time, no credit card required.

No card required

Our Free plan gives you

- 3 users

- 5,000 contact management

- Limited contacts & companies

- Lead Source Tracking

$12

Per user, per month.

Pro

Essential tools to help you grow, perfect for individuals and small teams.

Free 14-day trial. No card required.

Everything from Free, and

- Bulk Contact Import/Export

- 2 Sales Pipeline Management

- Lead Scoring

- Sales Automation

- Workflow Tracking

- Task Reminders

Most Popular

$28

Per user, per month.

Elite

Unlock advanced features and priority support, built for scaling businesses.

Free 14-day trial. No card required.

Everything from pro, and

- Unlimited Sales Pipeline Management

- Email Automation

- Social Media Integration

- Form Builder

- Messaging and live chat

FAQ

Frequently Asked question

Everything you need to know about the product and billing.

What does CRM stand for in banking?

CRM in banking stands for Customer Relationship Management. It helps banks manage customer data, improve services, automate workflows, enhance customer retention, and more.

What is the best CRM for banking?

The CRM with efficient features like lead management, contact management, workflow automation, communication platform, and more is considered to be the best CRM for banking. LeadHeed CRM is one of the leading bank CRMs with all these features.

What is the primary goal of CRM in banking?

The primary goal of CRM in banking is to build stronger customer relationships, satisfaction, and automation of banking activities for better service and efficiency.

How does LeadHeed CRM help banks improve customer relationships?

LeadHeed CRM provides a 360-degree view of customers to allow banks to personalize services, track interactions, and develop strong relationships through communication.

Can LeadHeed CRM streamline loan and credit management?

Yes, LeadHeed CRM can simplify loan and credit management, tracking applications, repayments, and customer interactions for efficient processing of loans.

Is LeadHeed CRM compliant with banking regulations?

Yes, LeadHeed CRM complies with banking standards of secure handling of data and reporting to regulatory authorities.

How does LeadHeed CRM support multichannel communication?

LeadHeed CRM integrates multiple communication channels (email, phone, chat, SMS, etc) for seamless interaction with customers on their preferred platforms.

Still have questions?

Can’t find the answer you’re looking for? Please chat to our friendly team.