Sales forecasting and revenue forecasting are two essential tools for predicting business performance. They both rely on past data and pipeline activity for forecasting, so many people assume they mean the same thing. In reality, they serve different purposes and answer different questions about your company’s future.

Sales forecasting focuses on predicting how much you’ll sell, while revenue forecasting looks at how much money those sales will actually bring in. Mixing the two terms can lead to unrealistic targets, poor budgeting, and missed growth opportunities.

Understanding the difference between sales forecasting and revenue forecasting can help you make smarter decisions about hiring, inventory, pricing, and long-term planning. When you know what each forecast measures and how it works, you’re better prepared to manage financial risk and avoid costly surprises.

Highlights

- Understanding the difference between sales and revenue forecasting helps businesses plan accurately, set realistic goals, and make smarter financial decisions.

- Sales forecasting predicts what you will sell, and revenue forecasting estimates the money you will make.

- Combining revenue and sales forecasts gives a complete view of the business, reduces risks, and helps everyone work together toward shared goals.

Understanding Sales Forecasting

Sales forecasting is the process of estimating how many products or services a business expects to sell within a specific time period. It focuses on predicting future sales activity based on past performance, current pipeline data, and market trends. This type of forecast helps businesses anticipate demand, plan resources, and guide marketing efforts for better decision-making.

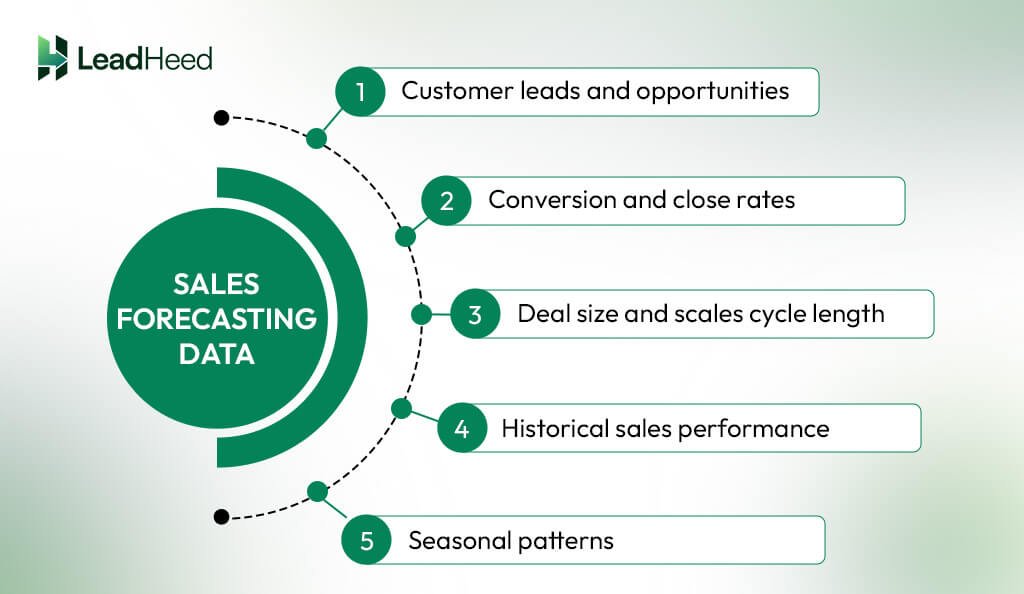

Sales forecasting typically relies on data such as:

- Customer leads and opportunities

- Conversion and close rates

- Deal size and sales cycle length

- Historical sales performance

- Seasonal patterns

Benefits of Sales Forecasting

- Forecasts support realistic and measurable sales targets.

- Teams can assign staff, time, and budgets more effectively based on expected sales.

- Managers use forecast data to make informed choices about pricing, marketing, and expansion.

- Sales forecasting provides clearer visibility into customer behavior and market trends, leading to better strategic decisions.

Challenges of Sales Forecasting

- Incomplete or outdated CRM data can lead to wrong predictions and unreliable forecasts.

- Changes in customer behavior, competition, or the economy can affect sales trends.

- Only looking at past sales misses changes in customer behavior or competitor moves.

What Is Revenue Forecasting?

Revenue forecasting is the process of estimating how much income your business may generate from sales over a certain time. It provides a clearer picture of a company’s financial health and future stability. This helps you plan budgets, manage cash flow, and make better decisions about hiring, marketing, and growth.

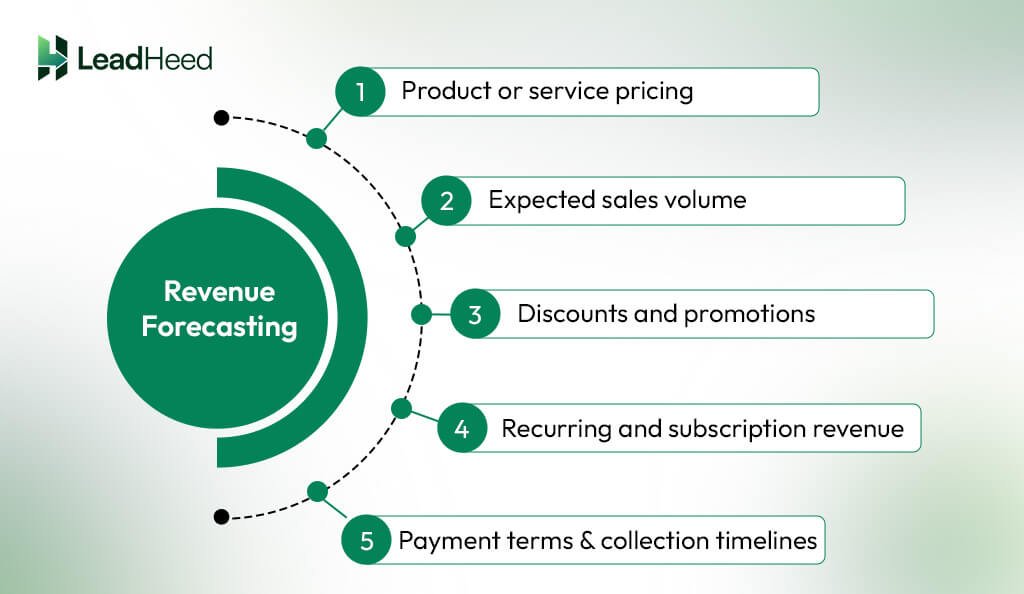

Revenue forecasting relies on data such as:

- Product or service pricing

- Expected sales volume

- Discounts and promotions

- Recurring and subscription revenue

- Payment terms and collection timelines

Benefits of Revenue Forecasting

- Companies create realistic budgets and control spending based on expected income.

- Businesses can prepare for upcoming expenses, avoid sudden shortages, and maintain healthier cash flow.

- Accurate forecasts show financial stability and build trust with investors and partners.

- Teams can detect possible revenue gaps before they affect operations.

Challenges of Revenue Forecasting

- Frequent changes in pricing models or discount offers reduce forecast accuracy.

- Multiple income sources, subscriptions, and contracts make tracking more difficult..

- Delays in payment or miscalculation affect income predictions.

Key Differences Between Sales Forecasting and Revenue Forecasting

Sales forecasting predicts how many products or services a business will sell, while revenue forecasting estimates the total income the business will earn from those sales. They mainly differ in their focus, metrics, purpose, and impact on business planning.

|

Factor |

Sales Forecasting |

Revenue Forecasting |

| Definition | Predicts the number of products or services a business expects to sell over a specific period | Estimates the total money a business is likely to earn from all sources, including sales, subscriptions, and renewals |

| Purpose | Supports sales teams in setting targets and managing performance | Guides the company’s overall financial planning, budgeting, and investment choices |

| Data Used | Past sales data, market trends, and customer demand | Sales data, pricing, contracts, subscriptions, and market conditions |

| Key metrics | Total Contract Value (TCV) and lead conversion rates | Monthly Recurring Revenue (MRR) and deferred revenue |

| Primary user | Sales and marketing teams for setting quotas and tracking rep performance | Finance and leadership for budgeting, tax planning, and investor reporting |

| Impact | Improves sales team efficiency and operational planning | Manages overall financial health, profitability, and strategic growth |

| Complexity | Simpler, fewer variables to track

|

More complex, includes multiple revenue streams and financial factors |

When to Use Sales vs Revenue Forecasting?

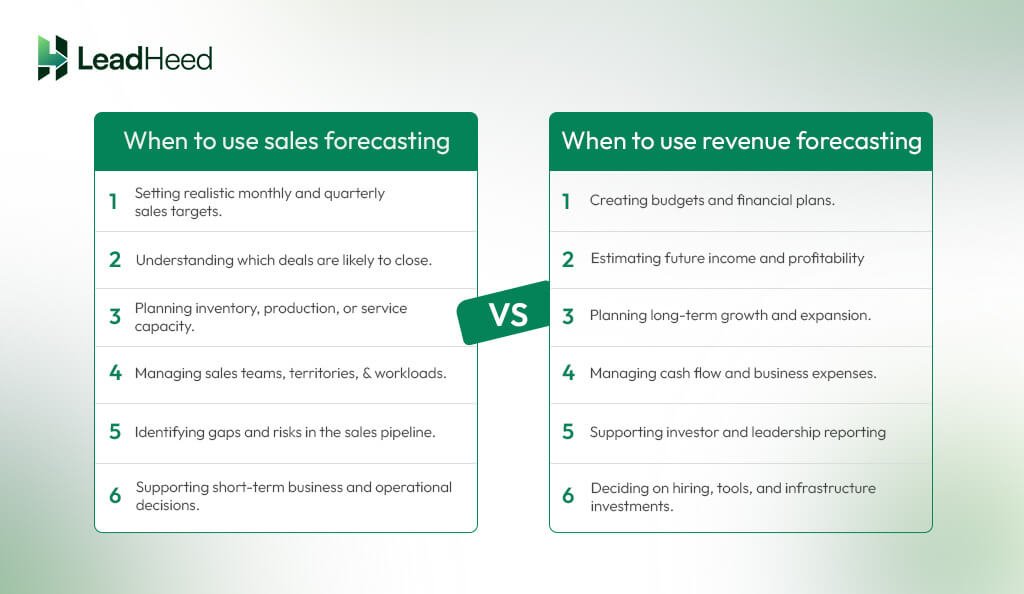

You should use sales forecasting to manage daily sales activities, and revenue forecasting to plan budgets, cash flow, and long-term growth. Using the right one at the right time helps you make clearer decisions and keep your business on track.

Use sales forecasting when:

- Setting realistic monthly and quarterly sales targets.

- Understanding which deals are likely to close.

- Planning inventory, production, or service capacity.

- Managing sales teams, territories, and workloads.

- Identifying gaps and risks in the sales pipeline.

- Supporting short-term business and operational decisions.

Use revenue forecasting when:

- Creating budgets and financial plans.

- Estimating future income and profitability.

- Planning long-term growth and expansion.

- Managing cash flow and business expenses.

- Supporting investor and leadership reporting.

- Deciding on hiring, tools, and infrastructure investments.

Integrating Sales Forecasts and Revenue Forecasts

Integrating sales and revenue forecasts means combining predictions of future sales with expected revenue to get a complete financial picture. This approach helps businesses align sales activities with financial goals to improve coordination, increase transparency, and support smarter decision-making across departments.

Why Integration Matters

- Complete Business View: Integration gives leaders a full picture of sales activity and expected income in one place. The sales forecast shows the deals and pipeline activity, while the revenue forecast shows the actual money expected to come in.

- Improved Sales Strategy: With integration, sales teams set realistic targets based on revenue goals, while revenue teams can plan for cash flow and profitability. Together, they make the entire sales strategy more focused and effective.

- Enhanced Collaboration: Shared forecasting systems allow marketing, sales, and operations teams to work with the same integrated data. It improves teamwork and reduces reporting conflicts, leading to smoother workflows and improved results.

- Supporting Business Growth: Accurate integrated forecasts help companies prepare for expansion in a controlled and sustainable way. Leaders can evaluate whether future sales and revenue can support hiring, technology upgrades, and market entry.

- Faster Business Decisions: Integrated forecasting tools let you update forecasts as soon as new information comes in, like a deal closes, a customer delays, or the market shifts. You can instantly adjust plans, move resources, grab opportunities, or fix risks right away.

Common Mistakes To Avoid While Integrating Sales Forecasts and Revenue Forecasts

Integrating sales and revenue forecasts often fails when teams focus on a single metric, rely on gut feeling, ignore market changes, and skip regular reviews. Understanding these common mistakes helps teams build more accurate, realistic, and useful forecasts.

- Ignoring Team Collaboration: When sales and finance work separately, forecasts often don’t match. Without regular communication, assumptions about deals, revenue timing, or pricing create confusion and frustration across teams.

- Focusing on a Single Metric: Tracking only sales volume or only revenue creates a one-sided view, and high deal numbers don’t always mean strong revenue.

- Relying on Gut Feeling: Forecasting based on intuition rather than data introduces bias, slows decision-making, and reduces forecast reliability.

- Ignoring Market Changes: Failing to adjust forecasts for changes in demand, competition, or economic conditions makes predictions quickly outdated.

- Forgetting to Review Regularly: Without regular updates, forecasts quickly lose accuracy and lead to poor decisions.

Conclusion

Understanding the difference between sales forecasting and revenue forecasting is essential for smarter business planning. Sales forecasting shows what you are likely to sell, while revenue forecasting shows how much money you are likely to make. Understanding both and integrating them helps businesses avoid confusion, set realistic goals, and make better decisions.

LeadHeed’s CRM software helps businesses forecast sales and revenue with greater accuracy and clarity. It centralizes lead and customer data, tracks every stage of the sales pipeline with expected deal value, and provides real-time performance reports. These features help teams monitor deal progress, measure conversion rates, and predict future sales and revenue more reliably. Start using LeadHeed today.

FAQs

What is the difference between a sales forecast and a revenue forecast?

Sales forecasting predicts future sales volume based on pipeline data, while revenue forecasting combines sales forecasts with other income sources (subscriptions or service fees) to project the actual revenue.

Simply, sales forecasts answer “How much will we sell?”, while revenue forecasts answer “How much money will we actually bring in, and when?”

What is the most accurate forecasting method?

The most accurate forecasting methods depend upon data and goals. However, methods like multivariable analysis, advanced time series models like ARIMA or Prophet, and AI-based methods usually give the most accurate results.

What is the best tool for forecasting?

The best tool for forecasting depends on your business size and your goals.

- Excel or QuickBooks for small teams

- Anaplan, or Vena Solutions, for growing teams

Can Excel do forecasting?

Yes! Excel can do forecasting with its built-in functions that let you predict future numbers based on your past data.

- LINEAR for simple straight line prediction

- ETS for seasonal trends