Almost 80% of mortgage lenders use a CRM, and the adoption makes sense because mortgage work involves fast lead response, repeated follow-ups, partner coordination, and strict timelines. A mortgage CRM keeps leads, borrower conversations, tasks, and loan stages in one place, so your team stays consistent from first inquiry to closing.

A strong CRM for mortgage brokers helps you capture inquiries, track where each lead came from, automate reminders, and move loans through clear pipeline stages (pre-qual, application, processing, underwriting, and closed).

Here’s a quick list of the 9 best mortgage CRM software for brokers, lenders and loan officers in 2026, with features and pricing comparisons.

- Shape

- BNTouch

- Insellerate

- Total Expert

- Zeitro

- Surefire CRM

- Jungo

- Usherpa

- LeadHeed

| CRM Software | Standout Features | Plans & Pricing (per user) |

|---|---|---|

|

1. Shape

|

☑ Lead capture and routing

☑ Marketing sequences and automation

☑ Built-in calling and texting

☑ Pipeline tracking and reporting

|

Sales & Marketing CRM: $119/month. Point of Sale (POS): $47 per user, per month. Lead Funnels: $299 per month.Free trial: No (Request Demo) |

|

2. BNTouch

|

☑ Mortgage CRM with marketing automation

☑ Unlimited email campaigns and content

☑ Video marketing tools

☑ Team collaboration + lead distribution

|

Individual: $165/month + $125 activation fee Team: $190/month for 2 users (=$95/user/month) + $95 activation fee per userFree trial: No (Request Demo) |

|

3. Insellerate

|

☑ Lead routing and engagement tools ☑ Multi-channel communication

☑ Sales pipelines and workflows

☑ Reporting and performance tracking

|

Price: Contact sales

Free trial: No (Request Demo)

|

|

4. Total Expert

|

☑ Customer engagement + marketing automation

☑ Lead nurturing journeys

☑ Pipeline visibility for teams

☑ Reporting and dashboards

|

Free: $0

Professional: $1200/user/year

Free trial: Yes (Free plan)

|

|

5. Zeitro

|

☑ CRM + digital mortgage pipeline

☑ Borrower portal and document flow

☑ Team access and collaboration

☑ Simple setup with a free plan

|

Explorer: Free Free trial: Yes (free plan)

|

|

6. Surefire CRM

|

☑ Mortgage marketing engine + CRM

☑ Automated “set-it-and-forget-it” workflows

☑ Borrower and partner nurture

☑ Content-driven outreach

|

Price: Contact sales

Free trial: Not available

|

|

7. Jungo

|

☑ Mortgage CRM built on Salesforce

☑ Referral partner relationship tracking

☑ Pipeline and task workflows

☑ Reporting inside Salesforce

|

Jungo Mortgage App: $96/month [$119, if billed annually]

Jungo Bundle: 125/month [$149, if billed annually]Free Trial: No (Book Free Demo)

|

|

8. Usherpa

|

☑ Marketing CRM for loan officers

☑ Done-for-you automated campaigns

☑ Daily action plan and reminders

☑ Referral partner follow-up support

|

Price: Contact sales

Free trial: Not available

|

|

9. LeadHeed

|

☑ Lead capture (web forms, socials)

☑ Lead filters (source, tags, owners)

☑ Pipeline stages and task follow-ups

☑ Sales tracking and reporting

☑ Automation and reminders

|

Free: $0/month (up to 3 users)

Pro: $15/month Elite: $35/month Free trial: 14 days

|

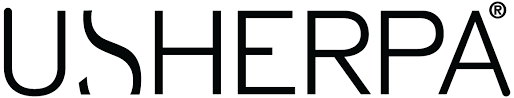

1. Shape

Shape is an AI-powered mortgage CRM software built for lenders, loan officers, and mortgage brokers who need to respond quickly and stay consistent with follow-ups. It puts lead management, smart pipelines, and communication (call, text, email) in one system.

Shape allows your team to move a borrower from first inquiry to closing while following up efficiently. It focuses heavily on automation and ready-to-use marketing content, plus onboarding support to get teams live faster.

Features:

✔ AI lead scoring to prioritize the best borrowers first

✔ AI communications to handle texts, inbound calls, and outbound dialing

✔ AI call analytics for quick call summaries, notes, and next steps

✔ Compliance tracking with checklists, reminders, and audit logs

✔ Custom pipelines and fields for your loan workflow

✔ Document tracking to keep files and requirements organized

✔ Task management and team collaboration logs

✔ LOS integration (Encompass, LendingPad, Calyx, Arive, etc.)

| Pros | Cons |

|---|---|

| ✅ Helps your team respond faster by scoring and prioritizing leads ✅ Reduces “forgotten follow-ups” because the system keeps next actions visible ✅ Improves compliance confidence with audit trails and deadline tracking ✅ Keeps borrower conversations and loan progress in one workflow ✅ Works well for smaller teams that need structure without heavy processes |

❌ Interface can feel less modern and may need more training ❌ Setup can take time (often measured in weeks, not days) ❌ If you want deep marketing automation, other tools may offer more |

Plans & Pricing:

Sales & Marketing CRM: $119/month.

Point of Sale (POS): $47 per user, per month.

Lead Funnels: $299 per month.

Free Trial: No (Request Demo)

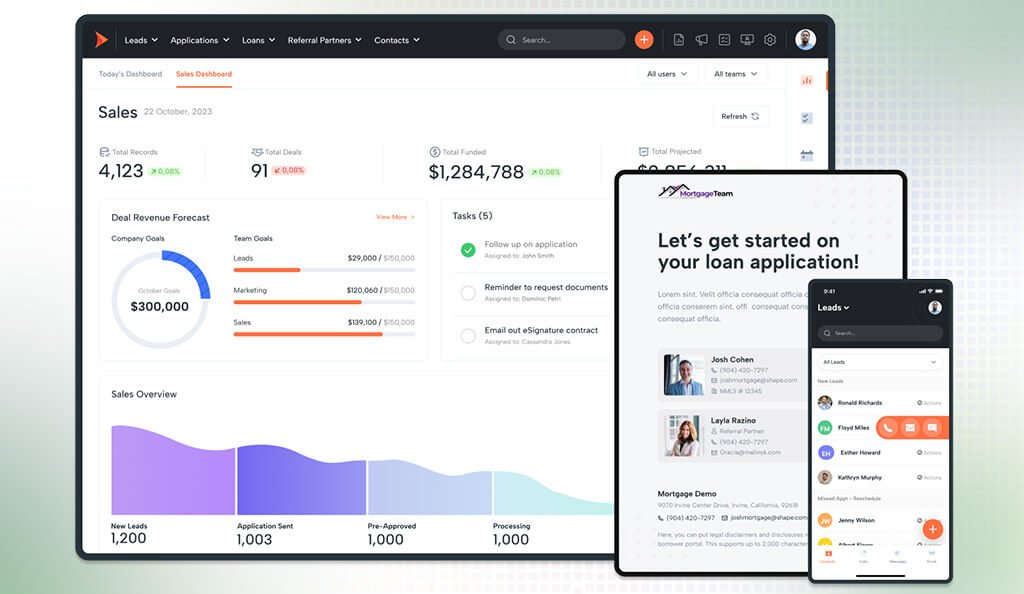

2. BNTouch

BNTouch is a mortgage CRM software that focuses heavily on marketing automation. It helps mortgage brokers and loan officers stay top-of-mind with leads, borrowers, and referral partners using pre-built campaigns, email/SMS/video marketing, and alerts like refinance opportunities and loan anniversaries.

BNTouch CRM also includes a digital loan platform with borrower/partner portals and document workflows, so your team can manage both follow-up and loan progress in one system.

Features:

✔ Unlimited email campaigns + 180+ premade content pieces

✔ Unlimited video marketing from inside the CRM

✔ SMS and voice marketing add-on for automated outreach

✔ Digital loan platform (online 1003, digital document management, borrower/partner portals, status updates)

✔ Post-funded follow-up workflows (long-term nurture after closing)

✔ Integrations: LendingPad LOS, Zapier, Outlook/Gmail, Optimal Blue, RingCentral (call/SMS logging + click-to-call)

| Pros | Cons |

|---|---|

| ✅ Keeps outreach consistent with prebuilt campaigns and automation ✅ Strong for long-term borrower and partner nurturing after closing ✅ Combines CRM + marketing + borrower portal in one workflow ✅ Helps teams reduce manual follow-ups with alerts and reminders ✅ Supports LOS sync (example: LendingPad) to reduce double entry |

❌ SMS/voice features are an add-on, so the total cost can increase ❌ Contact record limits apply (plan-based limits exist) |

Plans & Pricing:

Individual: $165/month + $125 activation fee

Team: $190/month for 2 users (=$95/user/month) + $95 activation fee per user

Free Trial: No (Request Demo)

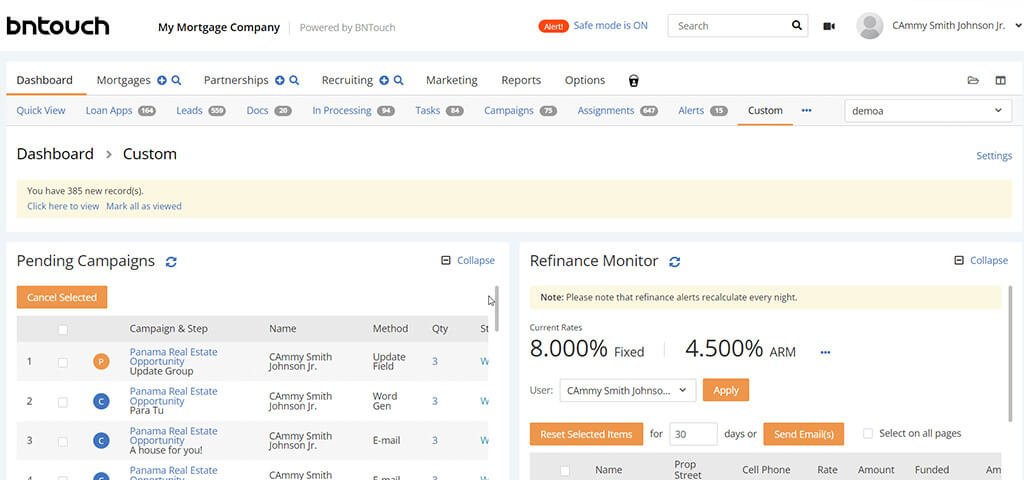

3. Insellerate

Insellerate is a CRM and engagement platform for loan officers and lenders who want tighter follow-up without switching between multiple tools. It combines lead management, pipeline tracking, and call routing with outreach tools to stay visible across the full borrower journey.

Insellerate supports outreach across social media, email, direct mail, compliant text messaging, ringless voicemail, and phone calls, so your team can keep leads warm and follow up consistently from one system.

Features:

✔ Intelligent lead distribution and management

✔ Strong referral partner management for agents and partners

✔ Lead and workflow prioritization to keep next actions clear

✔ Inbound and outbound call routing for sales teams

✔ Multi-channel marketing automation (email, SMS, direct mail, ringless voicemail, social)

✔ Native mobile support for working on-the-go

✔ LOS Integrations: Encompass and MeridianLink

| Pros | Cons |

|---|---|

| ✅ Helps teams stay consistent with follow-ups across multiple channels ✅ Improves visibility by keeping lead activity and pipeline progress in one place ✅ Strong for building repeat business with referral partner engagement ✅ Supports sales teams with routing and prioritization, so hot leads get attention faster ✅ Useful for lenders that want one system for lead-to-close and post-close nurturing |

❌ Can feel feature-heavy if you only want basic contact tracking ❌ Engagement tools work best when your team follows clear content and compliance rules |

Plans and Pricing:

Custom pricing tailored to your mortgage brokerage needs.

Free Trial: No (Request Demo)

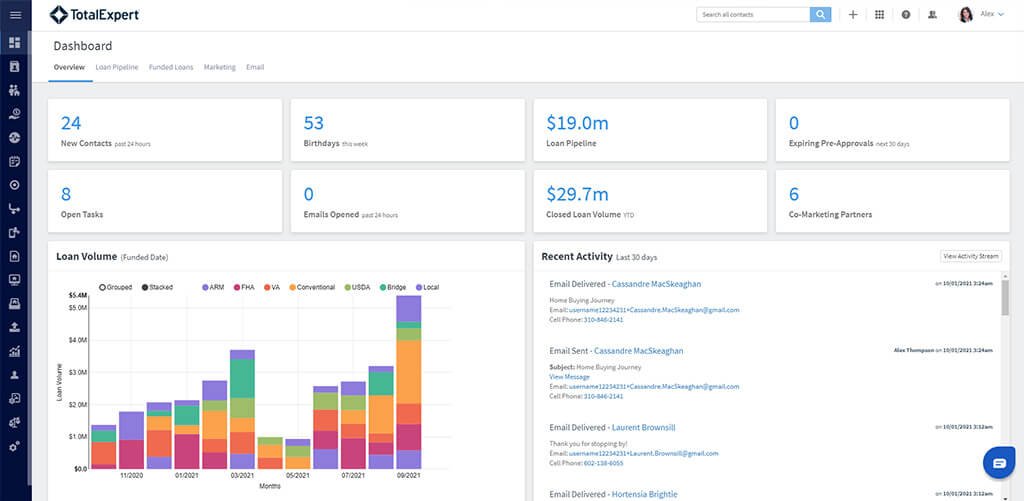

4. Total Expert

Total Expert is a mortgage CRM software and customer engagement platform built for lenders, brokers and loan offices that want structured, automated outreach across the full borrower lifecycle. It helps you run personalized customer journeys that keep prospects engaged from first inquiry to closed loan.

Total Expert CRM connects loan and engagement data, so your team can trigger outreach based on pipeline movement and borrower behavior. It’s useful when you manage high lead volume or long nurture cycles.

Features:

✔ Intelligent automation for personalized borrower journeys

✔ Customer lifecycle engagement for lending (from prospect to post-close)

✔ Integrations ecosystem (Encompass and Empower LOS)

✔ Partner and engagement triggers (example: integrations can trigger journey actions)

| Pros | Cons |

|---|---|

| ✅ Helps standardize follow-ups using automated customer journeys ✅ Strong for long-term nurture (pre-close and post-close retention) ✅ Supports data-driven outreach based on borrower behavior and pipeline progress ✅ Works well for lender teams that need consistent messaging at scale ✅ Supports LOS integration (example: Empower bidirectional sync) |

❌ Best suited to teams; may feel heavy for a solo broker using basic tracking ❌ Implementation can depend on integrations and internal workflows |

Plans and Pricing:

Free: $0 (limited features)

Business: Custom pricing tailored to your mortgage brokerage needs.

Free Trial: Yes (free plan)

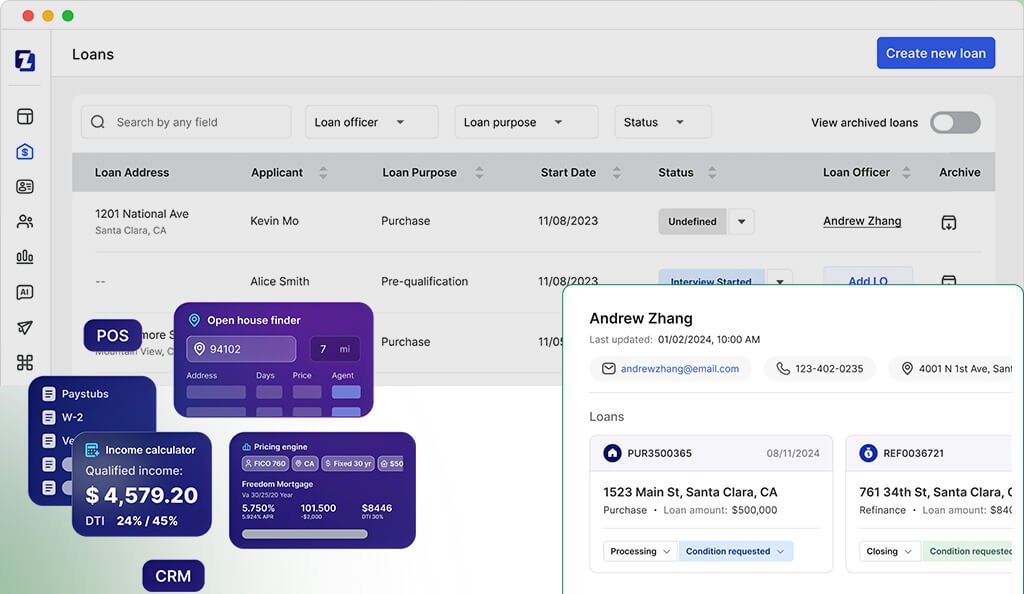

5. Zeitro

Zeitro is an AI-powered mortgage servicing software that combines a CRM, a digital borrower application, and automated document workflows in one platform. It helps you keep leads, tasks, and loan stages organized while reducing manual work during document collection and review.

Zeitro offers a free plan to test the system, and paid plans start at a low monthly cost, which makes it easier for smaller teams to adopt without a big upfront spend.

Features:

✔ Digital 1003 (POS) for borrower applications

✔ Built-in CRM + loan pipeline tracking from lead to closing

✔ Task management with reminders and milestone tracking

✔ AI document review and automated condition collection

✔ AI income calculator to support faster pre-qual work

✔ Loan tracking dashboard with real-time alerts and borrower updates

✔ SOC 2 security positioning for data protection

✔ LOS Integrations (Encompass, LendingPad, and MeridianLink)

| Pros | Cons |

|---|---|

| ✅ Easy to try because it includes a free plan ✅ Keeps your work organized with one view of leads, tasks, and loan progress ✅ Reduces manual follow-ups with alerts, milestones, and borrower updates ✅ Helps speed up processing with AI-based document review and condition workflows ✅ Supports LOS connections (useful when you want no double entries) |

❌ Business plan includes up to 30 users, but extra users cost more per month ❌ If you only want a basic CRM (no POS or AI tools), it may feel like more than you need |

Plans and Pricing:

Explorer: Free (limited features)

Individual: $8/month per user

Business: $35/month (up to 30 users) + $8/month per additional user

Free Trial: Yes (free plan)

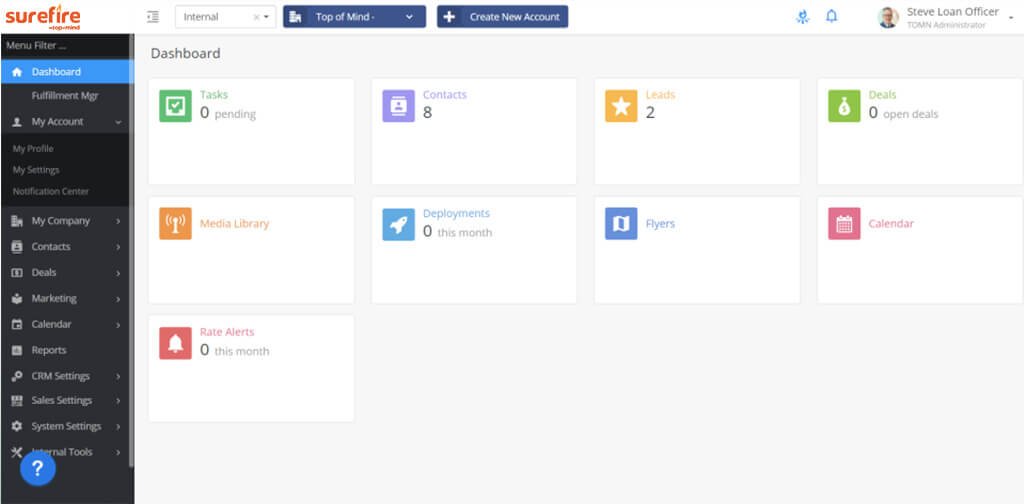

6. Surefire CRM

Surefire CRM (by Top of Mind) helps mortgage brokers and lender teams stay consistent with outreach from first lead to post-close follow-up. It automates borrower communication around loan milestones, nurtures leads toward application, and keeps the relationship warm after closing to drive repeat and referral business.

If your biggest challenge is “we close the loan, then we disappear,” Surefire is built to solve that with workflows, content, and omnichannel outreach that runs in the background while your team focuses on active files.

Features:

✔ Automated outreach tied to loan milestones (pre-close + post-close)

✔ Lead distribution + nurture to application

✔ “Set-it-and-forget-it” rule-based workflows

✔ Content-driven marketing designed for mortgage audiences

✔ Integration ecosystem (LOS, POS, pricing engines) + open APIs

| Pros | Cons |

|---|---|

| ✅ Keeps borrower communication consistent without manual chasing ✅ Helps you stay top-of-mind after closing to generate repeat and referral business ✅ Reduces marketing “busy work” with automated workflows and ready content ✅ Works well when multiple team members touch the same borrower file ✅ LOS-linked milestones help outreach feel timely and relevant |

❌ Can feel heavy for solo users who only want basic contact tracking ❌ Implementation and integrations may take planning to get right |

Plans and Pricing:

Request a quote for custom pricing.

Free Trial: No (Book Demo)

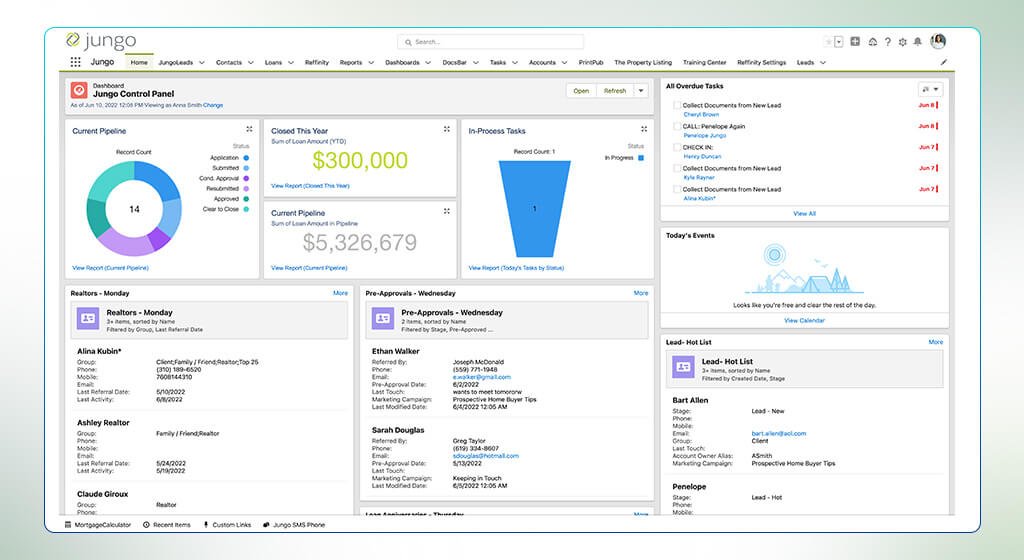

7. Jungo

Jungo is a CRM built on Salesforce. It is especially designed for mortgage brokers and real estate agents who want a structured system for referrals, borrower follow-ups, and pipeline tracking.

Because Jungo runs on Salesforce, you can use Salesforce reporting, the mobile app, and AppExchange add-ons to extend your workflow. This is useful when your team wants a long-term CRM foundation and does not want to switch systems later.

Features:

✔ Referral partner tracking (agents, builders, CPAs, past clients)

✔ Pipeline tracking inside Salesforce (custom loan stages and views)

✔ Mortgage marketing with templates and drip campaigns

✔ Salesforce mobile access for updates on the go

✔ Large integrations ecosystem (Encompass, Calyx Point, Byte, LendingPad, and others)

| Pros | Cons |

|---|---|

| ✅ Works well for teams that want a long-term CRM foundation on Salesforce ✅ Helps keep referral sources organized and easier to nurture consistently ✅ Reduces double entry when LOS integration is enabled and configured ✅ Gives strong reporting and visibility once your fields and stages are set ✅ Scales better than lightweight CRMs when your team and data grow |

❌ Setup can take longer because it runs on Salesforce and needs configuration ❌ Total cost can rise depending on package, add-ons, and Salesforce needs ❌ May feel heavy for solo brokers who only need simple follow-ups |

Plans & Pricing:

Jungo Mortgage: $96/month [$119, if billed annually]

Jungo Bundle: 125/month [$149, if billed annually]

Free Trial: No (Book Free Demo)

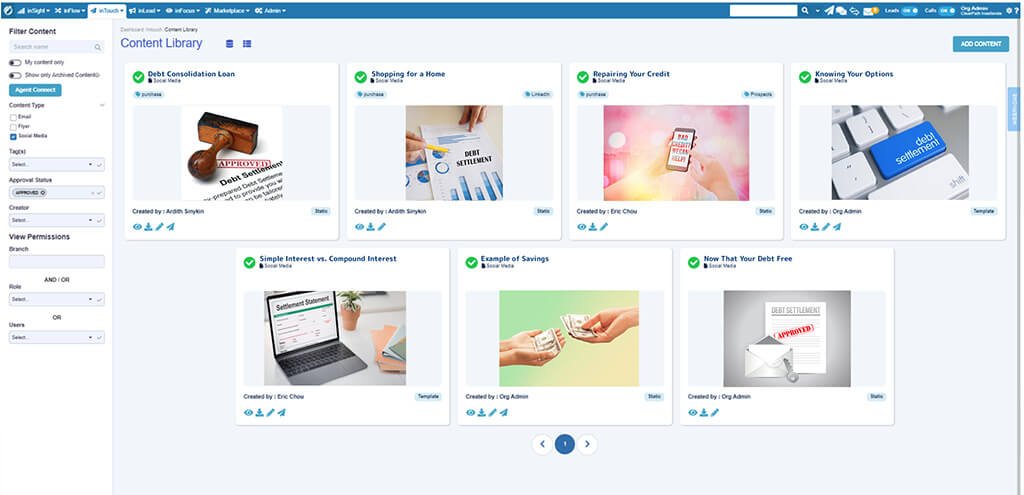

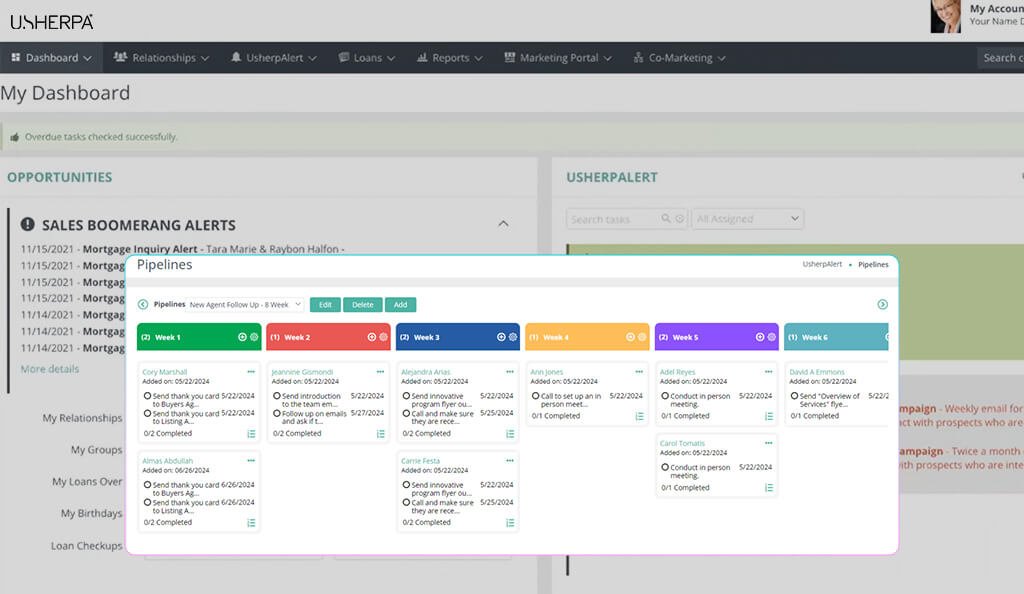

8. Usherpa

Usherpa is a CRM software for mortgage brokers and real estate agents who want consistent follow-ups without spending hours building campaigns. It combines a SmartCRM with automated, ready-to-run marketing and “data intelligence” that scans your database and surfaces daily opportunities you should contact.

Instead of treating your CRM like a storage box for contacts, Usherpa pushes you toward action. Its pipelines help you run repeatable workflows (tasks + outreach) and can alert you inside the platform, by email, and on mobile.

Features:

✔ Done-for-you automated marketing for borrowers and referral partners

✔ Data intelligence alerts that highlight high-probability opportunities

✔ Pipelines (workflow management) with tasks and notifications

✔ Built-in CRM actions (call/text/note) from contact views and dashboards

✔ SMS compliance guidance for mortgage texting (10DLC)

✔ Integrations via Zapier (connect Usherpa with other apps)

| Pros | Cons |

|---|---|

| ✅ Keeps marketing consistent with done-for-you campaigns ✅ Helps you spot “hidden” opportunities using data intelligence alerts ✅ Supports repeatable workflows using pipelines and task prompts ✅ Helps reduce compliance risk with SMS compliance guidance and structure ✅ Useful for relationship-building with borrowers and referral partners |

❌ LOS integration options can be more limited than many mortgage platforms ❌ Pricing is not clearly published, so quick comparisons are harder |

Plans & Pricing:

Request a quote for custom pricing.

Free Trial: No (Request Demo)

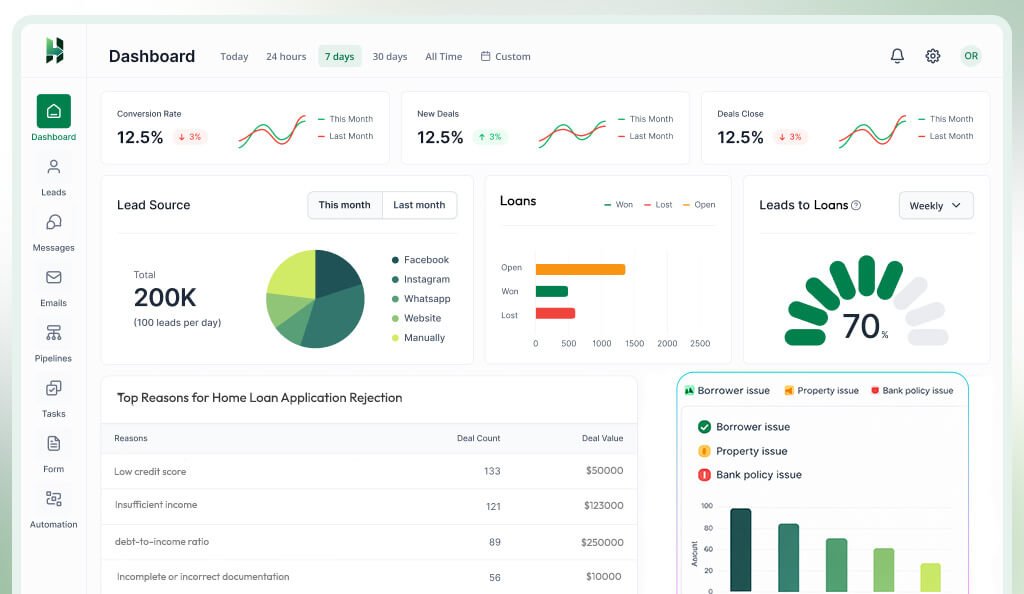

9. LeadHeed

LeadHeed is a simple, easy-to-use CRM for mortgage brokers, lenders and loan officers who want a clean system without a complex setup. It helps you capture leads, organize contacts, and move borrowers through a clear pipeline using stages like pre-qual, application, processing, underwriting, and closed.

LeadHeed keeps your work consistent. You can tag leads by source, assign owners, set reminders, and track every interaction in one timeline. This structure helps your team follow the same process for every borrower and reduce missed follow-ups.

Moreover, you can integrate LeadHeed with your telephony system, so your team can handle phone calls and SMS follow-ups inside the same system where you manage borrowers and pipeline stages.

Its omnichannel workflow lets you manage conversations across WhatsApp, Facebook, Instagram, and email in one place.

Features:

✔ Lead capture (web forms, social channels)

✔ Lead filters (source, tags, owners)

✔ Pipeline management (custom stages + overdue alerts)

✔ Task management and activity history

✔ Sales tracking and reporting

✔ CRM automation and reminders

✔ Omnichannel conversations (calls, SMS, social channels)

✔ Email and telephony integration

| Pros | Cons |

|---|---|

| ✅ Keeps borrower follow-ups consistent with tasks and reminders ✅ Makes lead organization easy with tags, filters, and source tracking ✅ Helps teams stay aligned using clear ownership and activity history ✅ Clear pipeline visibility, so you can spot stuck deals early ✅ Easy to adopt for brokers who want a simple daily workflow |

❌ Not a mortgage-only platform, so you may need to customize stages and fields ❌ Doesn’t have built-in LOS |

Plans & Pricing:

Free: $0/month (up to 3 users)

Pro: $15/month

Elite: $35/month

Free trial: 14 Days

Conclusion

A mortgage CRM helps loan officers, brokers, and lenders stay organized, follow up on time, and move every borrower through a clear pipeline. It keeps leads, conversations, tasks, documents, and loan stages in one place, so you do not lose deals because of missed reminders or scattered updates.

Before choosing a mortgage CRM software, focus on the basics that drive results: lead capture, pipeline tracking, automation, communication history, and LOS integration.

If you want a simple system to get started, LeadHeed is the best CRM for mortgage brokers and companies. You can use the Free plan to see how it fits your workflow, and then try the free trial on paid plans if you need more features. Start your free trial today!!

FAQs

What is a mortgage CRM?

A mortgage CRM is software that helps loan officers and mortgage brokers manage leads, borrower conversations, tasks, and loan pipeline stages in one place. It helps you follow up on time and keep each file moving for more closed loans.

What is the difference between a mortgage CRM and an LOS?

A mortgage CRM manages relationships and follow-ups (leads, referrals, communication, tasks), while an LOS manages the loan file itself (applications, disclosures, processing, underwriting, closing). Many teams use both and integrate them to reduce double entry.

What features should I look for in mortgage CRM software?

Your mortgage CRM software must have features such as lead capture, source tracking, pipeline stages, task automation, communication history (calls/SMS/email), and reporting. LeadHeed has all these CRM features to help you close more loans.

Does a mortgage CRM support calls and SMS?

Some CRMs include built-in calling and texting, while others can be integrated with your telephone system, letting you make calls and SMS directly from the CRM.

Is there a free mortgage CRM?

Some CRM platforms, including LeadHeed and Zeitro, offer a Free plan, which makes it easier to test the workflow before upgrading. With LeadHeed, you can test their paid plans as well, with a 14-day free trial.

What pipeline stages should I use in a mortgage CRM?

Most teams use stages like: new lead → pre-qual → application → processing → underwriting → clear to close → closed. You must keep stages simple, then refine after your team starts using the CRM daily.

What is the best CRM for mortgage?

The best CRM for mortgage in 2026 are Shape, BNTouch, Insellerate, Total Expert, Zeitro, Surefire CRM, Jungo, Usherpa, and LeadHeed.

What CRM does Real Brokerage use?

Real Brokerage uses Lofty (formerly known as Chime in many agent communities) through its official partnership program.