Grow Your Insurance Business with LeadHeed CRM for Insurance & Insurance Agents

LeadHeed CRM for Insurance simplifies client management, automates tasks, and improves service. Enhance efficiency and build stronger relationships transform your insurance business today!

Free 14-day trial

No credit card required

Cancel anytime

Trusted and Recommended By 1000+ Industry Leaders

How to Set Up LeadHeed CRM Software for Insurance Industry?

Setting up LeadHeed CRM for insurance industry is simple. To get started, sign up, import client data, create custom fields for policies, and segment contacts. Also, set automated reminders, assign tasks, and integrate insurance tools for streamlined management.

Start your free trial today!

Unlock the full potential and

ready to take your sales to the next level.

What is an Insurance CRM?

An insurance CRM is software designed to help insurance agents and brokers develop relationships with their clients. The software stores and manages all contact information in one place, allowing users to quickly access important information such as policy types, claims history, and renewal dates.

With streamlined communication and improved organization, an insurance CRM allows agents to do what they do best: develop solid relationships with clients and grow their business.

Benefits of CRM Software for Insurance Agents & Brokers

CRM software is an essential tool that insurance agents and brokers can leverage to drive growth, enhance client relationships, and streamline their operations.

Organized Client Data

Centralize all client details, policy information, and interaction history for seamless access and better service with LeadHeed’s insurance CRM solutions

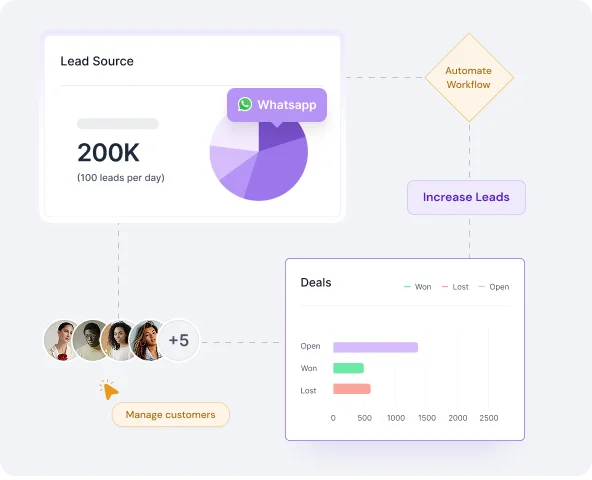

Lead Management

Capture leads from various sources, track them through every stage of the sales process, and nurture them into loyal clients.

Automated Reminders

Set up automated follow-ups for renewals, claims, and policy updates to ensure that no important task is missed.

Effective contact management is at the heart of any successful business strategy.

Improved Communication

Easily send personalized messages, policy updates, and reminders, fostering stronger relationships and better client retention.

Data-Driven Insights

Access real-time reports and analytics to evaluate performance, identify trends, and optimize sales strategies.

Streamlined Workflows

Automate routine tasks and reduce administrative workload, allowing agents to focus on what matters most—selling and serving clients.

What Kind of Insurance Agents Is LeadHeed’s CRM Software Best For?

LeadHeed is the best CRM for insurance agents of all types who want to automate tasks, manage policies, and strengthen client relationships.

Health Insurance Agents

Simplify policy management, automate claims handling, and follow up with clients on time with LeadHeed’s health insurance CRM.

Life Insurance Agents

Better organize with a flexible life insurance CRM and close more high-value life insurance deals.

Independent Insurance Agents

Centralize customer data, track customer interaction, and automate follow-ups using LeadHeed CRM.

Auto Insurance Agents

Track leads & renewals, process claims faster, and provide personalized customer service at scale.

Insurance Aggregators

Centralize customer data, streamline sales pipelines, automate tasks, and boost multi-agent collaboration.

Insurance Broker

The best insurance broker CRM, with seamless lead tracking, policy management, and client engagement tools for maximum growth.

Comparison of Top CRM Software For Insurance Industry

Explore the best CRM software for insurance industry to boost efficiency and streamline your workflow. This quick comparison highlights top software based on features, ease of use, and compatibility, helping you choose the right fit for your business.

Features  Companies  | ||||

|---|---|---|---|---|

| Contact Management | ||||

| Mobile Access | ||||

| Task Management | ||||

| Document Storage | ||||

| Data Import/Export | ||||

| Email Management | ||||

| Lead Generation | ||||

| Pipeline Management | ||||

| Reporting/Analytics | ||||

| Policy Management | ||||

| Document Management | ||||

| Pricing | Starts from $12 per month | Starts from $15 per month | Starts from $29 per month | Starts from $65 per month |

LeadHeed’s Best CRM Features For Insurance Agencies, Brokers, & Agents

LeadHeed CRM offers enhanced features to automate operations and optimize activities for insurance agencies, brokers, and agents.

Client & Policy Management

Organize client information, track policies and renewals, and provide personalized service to each customer with LeadHeed’s insurance industry CRM.

Lead & Opportunity Management

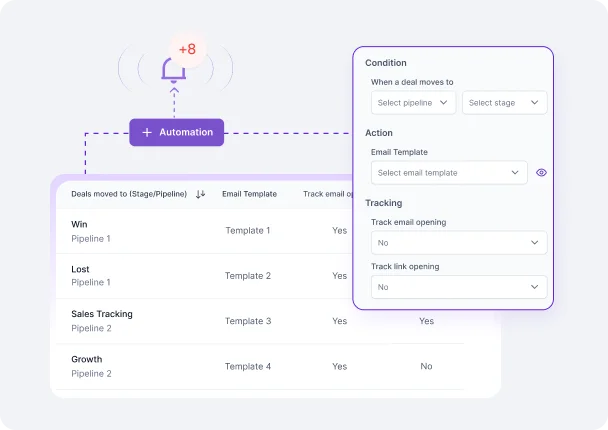

Capture leads, nurture them, and follow up on them as they progress through the sales pipeline, converting prospects into repeat customers with automated workflows.

Task Management

Keep track of your tasks with assignments, reminder calls, meetings, and due dates so you don't forget anything.

Communication Tools

Make use of in-built communication tools to contact customers by email, phone, or chat, all monitored within the CRM.

Reporting & Analytics

Create detailed reports and monitor important performance measures to help make informed decisions and improve business performance.

Mobile Access

View customer information, policies, and activities remotely via the LeadHeed mobile app for greater flexibility and efficiency.

Integration with Insurance Systems

Interoperate with your existing insurance systems like underwriting, policy management, and claims systems to provide seamless operations.

Collaboration & Team Management

Enable effective collaboration with shared tasks, performance tracking, and team collaboration tools to make your agency run smoothly.

Surveys & Feedback Forms

Gather customer feedback through surveys to enhance your services, boost satisfaction, and enhance retention rates

PRICING

Select a plan that suits you

Pay Monthly

Pay Annually (Save up to 20%);

$0

Per user, per month.

Free

Get started with full access for a limited time, no credit card required.

No card required

Our Free plan gives you:

- 5 users

- 10,000 contact management

- Limited contacts & companies

- Lead Source Tracking

$15

Per user, per month.

Pro

Essential tools to help you grow, perfect for individuals and small teams.

Free 14-day trial. No card required.

Everything in Free plan, plus:

- Bulk Contact Import/Export

- 2 Sales Pipeline Management

- Lead Scoring

- Sales Automation

- Workflow Tracking

- Task Reminders

Most Popular

$35

Per user, per month.

Elite

Unlock advanced features and priority support, built for scaling businesses.

Free 14-day trial. No card required.

Everything in Team, plus:

- Unlimited Sales Pipeline Management

- Email Automation

- Social Media Integration

- Form Builder

- Messaging and live chat

$0

Per user, per month.

Free

Get started with full access for a limited time, no credit card required.

No card required

Our Free plan gives you

- 3 users

- 5,000 contact management

- Limited contacts & companies

- Lead Source Tracking

$12

Per user, per month.

Pro

Essential tools to help you grow, perfect for individuals and small teams.

Free 14-day trial. No card required.

Everything from Free, and

- Bulk Contact Import/Export

- 2 Sales Pipeline Management

- Lead Scoring

- Sales Automation

- Workflow Tracking

- Task Reminders

Most Popular

$28

Per user, per month.

Elite

Unlock advanced features and priority support, built for scaling businesses.

Free 14-day trial. No card required.

Everything from pro, and

- Unlimited Sales Pipeline Management

- Email Automation

- Social Media Integration

- Form Builder

- Messaging and live chat

FAQ

Frequently Asked question

Everything you need to know about the product and billing.

What is a CRM for insurance agents?

A CRM for insurance agents is a software that helps in the efficient management of clients, policies, leads, and sales.

Why do insurance agents need a CRM?

A CRM helps agents maintain client data better, automate follow-ups, track policies, and enhance sales and client loyalty.

What key features should an insurance CRM have?

Some key features that an insurance CRM must have are lead management, policy tracking, automation, communication features, analytics, integrations with other software, and others.

What is lead scoring in an insurance CRM, and why does it matter?

Lead scoring categorizes potential customers by the chance of their becoming customers, so agents know where to invest their time on the best leads.

How does policy tracking benefit insurance agents?

Policy tracking helps agents to monitor renewals, claims, and policy information, preventing missed opportunities and cancellations.

How do I choose the best CRM for insurance agents?

Look for features like customization, automation, compatibility with other software, reporting, and simplicity to match your company.

What are the best ways to use CRM for sales management?

Use a CRM to track leads, automate follow-ups, track sales metrics, and facilitate collaboration.

What is the best CRM for life insurance agents?

The best CRM for life insurance agents is the one that simplifies client management, automates follow-ups, and effortlessly tracks policies. A solution like LeadHeed CRM offers lead scoring, policy reminders, and integrated communication tools to boost sales.

How can CRM help improve customer retention in insurance?

A CRM enhances customer retention by automating renewal reminders, personalizes messages, and follows up promptly to improve client relationships.

How does a CRM assist with compliance and regulatory requirements?

It keeps secure records, tracks interactions, and helps comply with industry regulations through automated documentation.

Still have questions?

Can’t find the answer you’re looking for? Please chat to our friendly team.